Chemical Series I: Intro to Chemicals

Basic segmentation, economics, sub-industries and players of the most fundamental and violently cyclical industry.

This is the first installment of a series forming a comprehensive chemical industry primer.

Why study chemicals? The chart below gives us a good reason: the stock of Braskem — a leading Brazilian chemical company — has moved from $5 to $30 and back four times in the past two decades.

Chemicals is one of the most cyclical sectors in the economy. Its stocks don’t just mean revert — they often overshoot, in both directions. It seems as if the market always forgot, both at peaks and bottoms, that chemicals are cyclical. That amnesia offers patient players significant opportunities to position countercyclically.

It’s also an industry where capital allocation matters. Sharp operators can compound value across the cycle.

And then there’s the product itself. Chemicals are the building blocks of the modern world. Without them, modern industry —and life as we know it— doesn’t exist. This makes them fascinating and also quite ‘predictable’ in terms of structural long-term demand drivers.

Finally, chemicals sit at the heart of global supply chains. That makes them a frontline sector in today’s megatrends: deglobalization, population aging, and the energy transition. All of which could lead to market disruptions, again offering opportunities for educated players.

This introduction sets the stage. We'll cover the basic economics of the chemical sector, its structure and segmentation, and the key regions and players that shape it.

Index

Basic Chemicals segmentation

Economics and cycles

Commodities

Specialty

Framework for screening and selection

Short intros to the main chemical segments

Petrochemicals

Agriculturals

Industrial gases

Other inorganic lines

Other commodities primers and frameworks

Basic Chemicals segmentation

There are several ways in which we can segment the industry: chemical elements (organic vs inorganic and metallic), level of differentiation (commodities and specialties), and end-products (plastics, coatings, agriculturals, industrial inputs, among infinite more categories)

Starting from the basics, we have three segments based on chemical elements: organics, inorganics, and metallic. The organic branch is based on the element Carbon. The inorganic branch is based on all other non-metallic elements, like Potassium, Chloride, or Oxygen. Finally, the metallic elements like iron, copper, but also lithium, germanium, or calcium, are considered part of the mining and metallurgical industry, and not directly part of Chemicals.

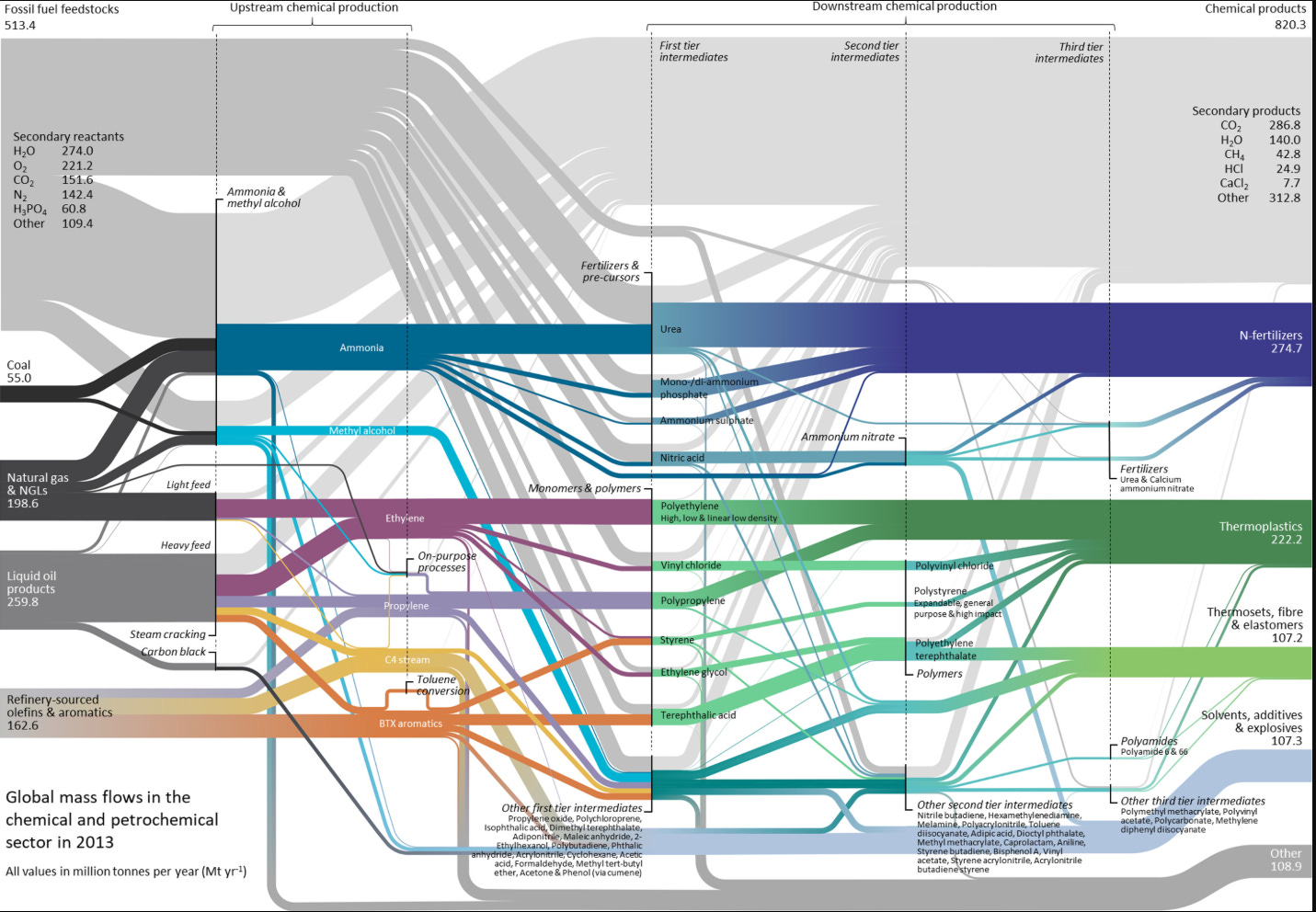

Of these three the organic segment is the most important by far. In fact, except for some specific instances, the inorganic branch is a necessary component for products where organic chemicals are the basis. The enormous majority of the organic chemicals are petrochemicals, i.e. they are derived from hydrocarbon resources like crude oil and natural gas. The petrochemical branch is the most important of the chemical industry, and forms the basis of many other segments like plastics, consumables, fertilizers, and pharmaceuticals.

Then we have levels of differentiation: commodities and specialties.

Commodity chemicals are generally undifferentiated, produced in large volumes through continuous processes, and are many times quoted on regional markets.

Specialty chemicals, on the other hand, are tailored for specific uses, often produced in smaller batches, and typically governed by specific supplier-customer contracts. At the further end of the specialty chain, many chemical-heavy companies are not considered chemicals but rather part of another industry, like Semiconductor Materials, Battery Makers, Pharmaceuticals, Crop Protection and Seeds, etc. These could be considered super-specialty chemicals.

As one moves along the value chain from basic raw materials toward end-products, specialty chemicals become more common; however, some finished goods remain commodities, while certain basic feedstocks can also be highly specialized.

We also have end product segmentation. Chemical end-products are infinitely diverse, so providing an exhaustive naming is impossible. Key categories include plastics, resins, and fibers, essential components in packaging, textiles, construction, and infrastructure. Paints and coatings form another significant end-market, vital for protective, aesthetic, and functional applications across industries. Chemicals also play a key role in agriculture as fertilizers and pesticides. Finally, we have chemicals as industrial inputs for electronics, food, cosmetics, cleaning agents, and pharmaceuticals.

Finally, the GICS standard which defines how stocks are generally classified talks of five segments: commodities, including early petrochemicals and inorganics, agriculturals, grouping fertilizers and pesticides, specialties, grouping a plethora of niche markets, industrial gases, focused on gas-elements like Oxygen, Hydrogen, etc., and diversified, made of super large chemical companies operating in several segments.

Economics and cycles

Each Chemical’s segment has its economic peculiarities, but we can still talk of general points for commodities and specialty. For commodities, key competition factors are the tremendous cycles driven by barriers to supply adjustment, the importance of cost leadership, particularly feedstock costs, and the low elasticity of demand. For specialty, key factors are IP, service levels, and end-demand volatility.

Commodities

The commodity chemicals industry is characterized by pronounced and lengthy cycles, typically spanning between three and seven years. The primary driver behind these extended cycles is the significant barriers to supply adjustment. Several factors contribute to these barriers:

The need to maintain consistent production volumes in process-oriented manufacturing, the necessity to dilute substantial capital expenditures and fixed overhead costs across larger volumes, and considerable economies of scale. This all leads to a bias towards higher production even when oversupplying the market.

The capital intensity and design complexities inherent in constructing new plants complicate the rapid addition of supply in incremental stages in undersupplied markets.

Storing and transporting many chemicals presents logistical challenges, so that regional markets can form pockets of oversupply.

Many chemicals are produced concurrently as co-products, making it difficult to curtail production selectively.

Consequently, chemical plants are usually operated at or near full capacity—even when doing so is uneconomical—and once facilities close, they typically remain shuttered for a long time. When producers keep expanding or cannot curtail supply when prices go down, and cannot or don’t want to expand supply when prices go down, you have the basic ingredient for violent cycles.

On the other side of the equation, demand for commodity chemicals is largely inelastic. Since chemical products often represent only a small portion of the total cost of finished goods, fluctuations in chemical prices rarely result in significant shifts in demand. Chemical companies commonly utilize margin-based pricing. When feedstock prices increase for all producers, companies generally maintain their margins, passing the higher costs onto consumers in the form of elevated end-product prices.

The demand for most commodity chemical products tracks population growth and increases in GDP per capita. For that reason, the two most relevant dynamics for future chemical demand are the growth of the emergent economies and the demographics of the developed economies.

Cost leadership is critical within the commodities chemical industry due to the widespread availability of multiple suppliers in a particular region. Many chemical commodities are globally or pan-regionally tradable and subject to international price arbitrage, reinforcing the necessity for competitive cost structures. A notable determinant of competitiveness is proximity to low-cost feedstocks, especially when these feedstocks are not easily traded internationally. For example, in the early stages of the petrochemical industry (olefins, aromatics, and early derivatives), producers located close to abundant natural gas or crude oil refining resources enjoy substantial cost advantages.

Specialty

As we shift our focus toward specialty products, market dynamics change. The transition between commodities and specialties is not clear cut, so that each subsegment is placed in a continuum between a pure commodity and a pure specialty.

Specialty segments generally enjoy better economics. This is because the supply-driven cycles are less pronounced. There are a few reasons for this:

Specialty markets generally feature fewer competitors, with barriers to entry like patent protection (IP). This is the case, for example, with pesticides, or specific industrial gases.

Production in these segments is often batch-based, with lower economies of scale and reduced capital intensity, diminishing incentives for capacity utilization.

Because of the specific nature of the products, specialty markets often present contract-based relationships between producer and supplier. This can reduce price and volume volatility.

However, as specialization increases and markets become narrower, demand volatility tends to rise, influenced significantly by the cycles at downstream industries. Thus, while cycles persist in specialty chemicals, they are predominantly demand-driven rather than supply-driven. Examples of this are demand for semiconductor high-purity gases (dependent on the cycles of semiconductor manufacturing) or demand for pesticides and crop treatments (dependent on the cycles of agricultural commodities).

Framework for screening and selection

With highly cyclical industries like chemicals, my selection framework consists in searching for segments undergoing a deep cyclical downturn, and selecting companies that are costs leaders in the segment, have manageable leverage, and are trading at low (<4x) multiples of cycle-average earnings.

For more information on the framework, please read the Cyclicals Framework article.

The main opportunity offered by chemicals is to position countercyclically in segments where the cycle is undergoing its negative portion, as prices tend to discount the most terrible catastrophes. When the cycle turns (a question of when, not if), the stocks of the surviving companies tend to rerate violently, aided by the compound effect of earnings and multiple expansion. The challenge is to select the companies that have the highest likelihood of surviving the cycle unscathed.

The first step consists of finding a segment where the cycle is currently very negative, either because of excess supply (commodity) or low demand (specialty). Earnings are decreasing, and so are stock prices. The more panic there is, the better. This indicates irrational pricing, because of pressure selling, or because there is actual fear that the industry will never recover.

The next step is finding a company that is operationally profitable during this stage of the cycle, and ideally that has been profitable during all previous instances of downcycles in the same segment. This indicates that the company is a low-cost leading producer.

The company should ideally have low financial leverage, and a cash balance to weather potential operational losses, if they happened. If it has financial debt, it should be fixed-rate, with an average maturity of more than 5 years, and interest should not represent more than 30% of operating income even during down periods. This indicates that the company has little to negligible bankruptcy risk.

The low-cost and low bankruptcy risk conditions are basic. They are the only guarantees that the company will survive the cycle even if it lasts for a long time and even if it is very violent. If the company is operationally profitable and financially sturdy, then other producers will close their doors earlier, therefore reducing supply, and adjusting the cycle upwards.

A bonus point is if the company has a history of counter-cyclical capital allocation. Indications of this are accumulation of cash and repayment of debts during boom periods, followed by aggressive CAPEX and M&A activity during bust periods. This is a bonus because companies like this can grow from the spoils of the previous excess cycles.

Finally, the price condition is that the stock should be priced at no more than 3 or 4 times the earnings during the average portions of previous cycles, adjusted for capacity changes in the current cycle. Buying cyclicals entails risk, and the turnaround may take a long time (cycles can last 3, 5, or 7 years easily), so the return should be commensurate with that. It makes no sense to pay 10x cycle-average earnings for a cyclical. The key word here is cycle-average.

After that, sit and wait. Turnarounds take time, and as Charlie Munger used to say ‘the big money is not in the buying and the selling, but in the waiting’.

Short intros to the main Chemicals segments

This section presents very succinctly each of the segments of the industry, including the main products, processes, companies, geographies, and basic economics. Ideally, each of these introductions will eventually be extended by a proper Primer to each of the segments.

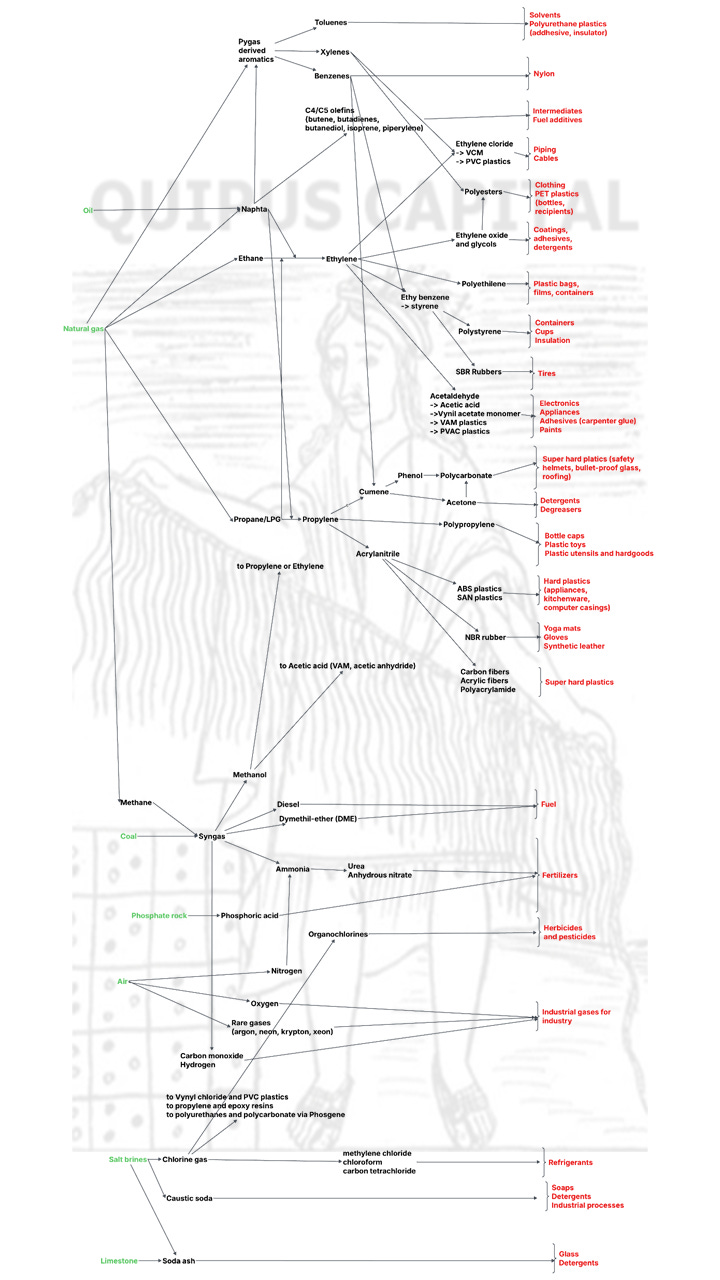

The picture below, although simplified, helps understand the main branches from natural resources (green) up to final products or specialty lines (in red).

Petrochemicals

Petrochemicals are the largest chemical segment by far. Competition in the commodity portion of the segment (early feedstocks) is based on low-cost feedstock availability, mainly the closeness to natural gas or crude oil sources. The difficulty of transportation of early petrochem feedstocks generates regional markets. Down the line, petrochemical products like plastics, fibers, rubbers, paints, etc. are more tradeable, with competition based on scale costs and margin pricing at a global scale.

Petrochemicals are by far the largest chemical segment by volume and economic importance. These chemicals underpin nearly all modern materials, especially plastics, but also extend their reach into fibers, paints, coatings, pharmaceuticals, and countless downstream industries.

The petrochemical value chain begins with two essential feedstocks: naphtha and natural gas liquids (NGLs)—primarily ethane, propane, and butane.

Naphtha emerges as a co-product from oil refining, while NGLs are byproducts of processing natural gas. This means the foundational elements of the petrochemical industry are essentially residues from fossil fuel extraction and refining, sometimes even holding negative economic value for producers. This scenario will dramatically evolve over the next half-century as the world transitions away from fossil fuels as primary energy sources, and therefore the main economic incentive to produce oil and gas shifts to petrochemicals.

From these initial feedstocks, the next step is producing olefins (ethylene, propylene, C4/C5) and aromatics (benzene, toluene, xylene). These feedstocks are also usually generated in continuous production processes and typically occur as co-products. Obtaining one element often involves producing some of the others simultaneously, with exact product ratios dependent on the chosen feedstock (for instance, using NGLs predominantly yields ethylene and propylene, while naphtha results in a more diverse product mix).

Beyond olefins and aromatics, the petrochemical landscape branches dramatically into myriad derivatives

The olefins open into at least 15/20 branches via core chemical reactions like polymerization, oxidation, halogenation, and alkylation. For example, the most significant petrochemicals are polyethylene and polypropylene—cornerstones of the plastics industry, both polymerizations—as well as ethylene oxide and propylene oxide, vital for rubbers and solvents, both oxidations. Hallogenation is used to generate PVC from ethylene, whereas alkilation is used to generate styrenes from ethylene and polycarbonates from polyethylene.

The aromatics reenter the chain later, by combining with olefin derivatives to create diverse materials like polystyrene (styrene and benzene), PVC (ethylene and xylenes), polyester (ethyl oxides and xylene), nylon (benzene and propylene derivatives), and rubbers.

Up to this point, production processes for these derivatives remain integrated within refining and petrochemical complexes. One practical reason is that olefins and other intermediate products are gases at ambient temperature, and despite being liquefiable under pressure, they pose challenges in long-distance transport. Their derivatives, often solid products, are significantly easier to transport, store, and trade globally.

The most important competitive advantage in the petrochemical sector hinges on access to low-cost feedstocks. Consequently, regions geographically linked to extensive oil refining or natural gas extraction infrastructure dominate in costs: the US and the Gulf Countries. The other two important regions, Northeast Asia (China, Japan, South Korea), and Northern Europe (Germany, Netherlands, Britain), often face higher costs due to reliance on imported crude oil. Still, Northeastern Asia represents 50% of the global plastics production capacity because it is an adjacent industry to oil refining.

Given the degree of integration, it is not surprising to find integrated O&G companies in this segment, like Exxon Mobil (US), Sinopec (China), and Saudi Aramco/SABIC(Saudi Arabia). Other important players are Dow and LyondellBasell, both from the US.

Agriculturals

Agricultural chemicals include one commodity industry, fertilizers; and a specialty industry, crop protection. Demand for agriculturals is more volatile than for petrochemicals, because it depends on the margins of agricultural production, itself a commodity industry.

Agriculturals are composed of two branches: crop protection and fertilizers.

Crop protection is a highly complex, specialty branch, where the driver of competition is intellectual property and niche market specialization. Fertilizers are primarily commodities, and competition is driven by access to cost-competitive feedstocks.

Interestingly, the agriculturals are themselves part of a commodity chain. Therefore, demand for agricultural products can be volatile, depending on the expected margin of agricultural producers. This is particularly true for large crops like soybeans, wheat, and corn. If agricultural commodity prices are low, and other feedstocks (like fuel) are high, the expected margin of the additional yield provided by more fertilizer or crop protection use may be low or even negative, reducing demand for these products.

Fertilizers

Plants obtain carbon directly from the air, but crucial nutrients like nitrogen, phosphorus, and potassium come from chemical fertilizers.

Nitrogen fertilizers are majoritarily urea and anhydrous ammonium nitrate. Both products stem from ammonia, which can be obtained from methane (natural gas) or coal gases via syngas.

In ammonia-based fertilizers, competitive advantage largely hinges on access to feedstocks. Companies in regions rich in these resources dominate the industry: CF Industries in the U.S., benefiting from abundant natural gas; and Sinofert in China, which relies heavily on coal-based processes. Europe also maintains significant players like Yara and OCI, although at a cost disadvantage due to higher feedstock prices. Ammonia’s gaseous state poses storage and transportation challenges. Consequently, it's usually more economical to manufacture derivatives like urea or nitrates near ammonia production facilities.

Phosphorus and potassium fertilizers straddle the line between mining and chemical processing. These nutrients originate from mined materials: phosphate rocks and potassium-rich minerals. Phosphate rocks undergo treatment with sulfuric acid—a by-product of metal refining processes, such as copper smelting. Potassium minerals, meanwhile, are converted into potash through a relatively straightforward purification method.

Here again, natural resources dictate the competitive landscape. Production predominantly occurs in regions with mineral reserves: the United States (Mosaic), Canada (Nutrien), Brazil (also Mosaic), and China (Sinofert).

Crop protection

The crop protection umbrella includes all sorts of pesticides like herbicides, fungicides and insecticides. Of these, herbicides account for more than two-thirds of the global volume of pesticides.

The segment is highly specialized. In many ways, it cannot be considered part of the chemicals industry anymore. Most of the leading products have IP protection, and are sold in a package with genetically-modified seeds. The products require strict governmental approvals before they are commercialized in a particular country. In this sense, crop protection is a lot like pharmaceuticals, a chemical-heavy industry that has branched out from chemicals. In fact, many crop protection companies were originally involved in pharma.

Despite the above, crop protection is important for chemicals because the largest crop protection companies (also the largest seed genetics companies) are owned by large chemical diversified conglomerates. That is the case of Syngenta (previously listed, not owned by Sinochem), Monsanto (owned by Bayer and now called Bayer CropScience), or the agricultural subsidiary of BASF.

Industrial gases

The industrial gases segment is the smallest of the chemicals. Just like all of the above, it includes both commodity and specialty sub-segments. Interestingly, even on the commodity sub-segment, logistical complexities make competition a combination of scale, service, decentralized production management, and IP.

The industrial gases segment includes at least four sub-segments: atmospheric or air gases (oxygen and nitrogen), synthesis gases (hydrogen, carbon monoxide, and syngas), rare gases (helium, xenon, neon), and specialty gases (high purity, medical).

Atmospheric, synthesis, and rate gases are used mostly in industry and are commodities . The processes involved like air separation, syngas gasification, and cryogenization, have been known for several decades. Still, the products are not highly tradeable because of storage and logistic challenges. Large users have to be directly connected via pipeline to the producer, therefore generating a tight producer-consumer coupling and long-term contracts with low volatility. Small and mid-size users can receive cryogenized tanks or replenishments. Competition in the SMID segment is therefore very dependent on service and distribution infrastructure.

The specialty sub-segment is highly atomized by end use, each requiring specific IP barriers. This is the case of high-purity gases used in low variability industrial processes like semiconductor manufacturing, or medical gases used in resuscitation or pharmaceutical production that require medical-regulatory body approvals.

Other inorganic lines

The remaining inorganics are fairly commoditized and not super complex. They are used mostly as inputs in other chemical processes. They include the following chains:

Chlor-Alkali process: salt waters (brines) can be separated into and include chlorines, important in plastics (PVC, epoxys,tc polycarbonates), and caustic soda, important in some industrial processes and detergents.

Fluor: The mineral fluorite is processed into hydrofluorocarbons, important refrigerants that are being phased off because of their greenhouse effects. Also in some polymers like teflon.

Soda ash: sodium carbonate (commonly called soda ash) is produced via an 1860s process mixing brines and limestone. It is used for baking soda (sodium bicarbonate), detergents (mainly for apparel) and glass-making.